Webinar replay - The view from Europe: UCITS and ETFs in a changing world

High-yield bond issuance: 5 traits lawyers should look for in a service provider

Fight the battle against payments fraud

LGBTQ+ estate planning considerations

LGBTQ+ retirement planning: What you need to know

How to retire happy

Retirement income planning: 4 steps to take

7 beneficiary designation mistakes to avoid

Reviewing your beneficiaries: A 5-step guide

Good money habits: 6 common money mistakes to avoid

Should rising interest rates change your financial priorities?

Is a Health Savings Account missing from your retirement plan?

How to keep your assets safe

6 ways to teach your kids about giving

Multiple accounts can make it easier to follow a monthly budget

How can you pay bills online the right way?

Your 4-step guide to financial planning

How grandparents can contribute to college funds instead of buying gifts

What is a good credit score?

What type of investor are you?

Saving vs. investing: What's the difference?

Understanding yield vs. return

A beginner's guide to investing

ABCs of BEC

Managing cross-border payments in emerging markets

4 reasons your Luxembourg fund needs an in-market administrator

Luxembourg's thriving private debt market

The unsung heroes of exchange-traded funds

Top 3 considerations when selecting an IPA partner

10 ways a global custodian can support your growth

Estate planning documents: Living trusts vs. will vs. living will

The benefits of bundling services for Luxembourg regulated funds

How does money influence your planning?

The benefits of a full-service warehouse custodian

4 ways to free up your budget (and your life) with a smaller home

Key considerations for launching an ILP

Navigate changing consumer behavior with service fees

Loud budgeting explained: Amplify your money talk

Webinar: Uncover the cost: Home renovation

How to access digital assets after a loved one's death

LGBTQ+ financial planning tips

Do your investments match your financial goals?

Retirement expectations quiz

Bull and bear markets: What do they mean for you?

ABCs of APIs: Drive treasury efficiency with real-time connectivity

Alternative assets: Advice for advisors

Ask an expert Q&A: 3 US ETF trends and their impact in Europe

For small business growth, consider the international market

MSTs: An efficient and cost-effective solution for operating a mutual fund

Rethinking European ETFs: Strategy wrappers and a means to an end

What is a CLO?

Case study: U.S. asset manager expands to Europe

What are exchange-traded funds?

An investor’s guide to marketplace lending

Examining in-demand fund structures

Interval funds find growing popularity

6 risks you need to manage when expanding your global footprint

A first look at the new fund of funds rule

Combined strength: Luxembourg and your fund administrator

3 questions to ask your equity, quant and CTA fund administrator

Easier onboarding: What to look for in an administrator

Easing complex transactions: Project finance case studies

ESG-focused investing: A closer look at the disclosure regulation

European loan agency: finding the right balance of agility and stability

High-yield bond issuance: how to avoid 5 common pain points

Luxembourg funds: 5 indicators of efficient onboarding

Luxembourg private capital growth demands your attention

Programme debt clients want reliable service – no matter where they’re based

Programme debt Q&A: U.S. issuers entering the European market

Service provider due diligence and selection best practices

Custody or safekeeping: What’s the right solution for government investments?

3 tips to maintain flexibility in supply chain management

Inherent flexibility and other benefits of collective investment trusts

The reciprocal benefits of a custodial partnership: A case study

The secret to successful service provider integration

Insource or outsource? 10 considerations

Depositary services: A brief overview

Benefits of billing foreign customers in their own currency

Improve government payments with electronic billing platforms

Refinancing your practice loans: What to know

What type of loan is right for your business?

Beyond Mars, AeroVironment’s earthly expansion fueled by U.S. Bank

Know your customer: How updated rules affect M&A closings

The value of engaging a professional paying and exchange agent

5 tips for a successful joint venture

3 innovative approaches to ESG investing in Europe

Administrator accountability: 5 questions to evaluate outsourcing risks

The AI journey in finance: How to make it part of your strategy

European outlook: Trustee experience more important than ever

Housing market trends and relocation impact

How liquid asset secured financing helps with cash flow

The ongoing evolution of custody: Tips for renewing your custody contract

Blockchain: Separating hype from substance

Liquidity management: A renewed focus for European funds

Emerging trends in Europe: An outlook from multiple perspectives

IRC Section 305(c): Deemed distributions and related regulations

Hybridization driving demand

Leveraging the ASC-842 rule changes in equipment lease accounting

The role of a custodian

Retirement savings by age

Payment industry trends that are the future of POS

3 ways POS data analysis can help define your brand

Opening a second location? Cloud-based POS is key to a smooth unveiling

5 things to avoid that can devalue your home

What are conforming loan limits and why are they increasing

What you need to know before buying a new or used car

Everything you need to know about changes to Form 8038-CP reporting

The benefit of a multi-jurisdictional European trustee

Travel

Celebrate a big event

Pursue a passion

How does an IRA work?

IRA vs. 401(k): What's the difference?

Key milestone ages as you near and start retirement

Non-retirement investing: Investment options outside of retirement accounts

Should I itemize my taxes?

Start a Roth IRA for kids

Proactive ways to fight vendor fraud

Business risk management for owners of small companies

Avoiding the pitfalls of warehouse lending

5 Ways to protect your government agency from payment fraud

How to improve your business network security

The latest on cybersecurity: Mobile fraud and privacy concerns

Complying with changes in fund regulations

What is CSDR, and how will you be affected?

Cybersecurity – Protecting client data through industry best practices

Fraud prevention checklist

Government agency credit card programs and PCI compliance

Post-pandemic fraud prevention lessons for local governments

Risk management strategies for foreign exchange hedging

Best practices on securing cardholder data

Third-party vendor risk: protecting your company against cyber threats

Turn risk into opportunity with supply chain finance

Cybercrisis management: Are you ready to respond?

Maximizing your infrastructure finance project with a full suite trustee and agent

How institutional investors can meet demand for ESG investing

8 steps to take before you buy a home

Preparing for retirement: 8 steps to take

Addressing financial uncertainty in international business

Creating the ideal patient journey

3 benefits of integrated payments in healthcare

3 ways to make practical use of real-time payments

Instant Payments: Accelerating treasury disruption

Standardizing healthcare payments

Take a fresh look: mass transit is going places

White Castle optimizes payment transactions

Why powerful online portals are tailor-made for the public sector

Webinar: CSM corporation re-thinks AP

Integrated payments healthcare benefits

Drive digital transformation with payments innovation

Unexpected cost savings may be hiding in your payment strategy

Want AP automation to pay both businesses and consumers?

Ways prepaid cards disburse government funds to the unbanked

Webinar: Approaching international payment strategies in today’s unpredictable markets.

Digital banking and cloud accounting software: How they work together

Three healthcare payment trends that will continue to matter in 2022

5 reasons to upgrade B2B payment acceptance methods

Rent payments: What’s changing for commercial real estate

Consolidating payments for healthcare systems

Evaluating interest rate risk creating risk management strategy

ePOS cash register training tips and tricks

How to make the most of your business loan

5 tips for managing your business cash flow

Restaurant surveys show changing customer payment preferences

Restaurant surveys show changing customer payment preferences

Gifting money to adult children: Give now or later?

Lost job finance tips: What to do when you lose your job

Transition to international ACH

Money Moments: How to finance a home addition

Increase working capital with Commercial Card Optimization

Modernizing fare payment without leaving any riders behind

4 benefits to paying foreign suppliers in their own currency

3 reasons governments and educational institutions should implement service fees

A simple guide to set up your online ordering restaurant

Tap-to-pay: Modernizing fare payments pays off for transit agencies and riders

Tech tools to keep your restaurant operations running smoothly

The future of financial leadership: More strategy, fewer spreadsheets

The surprising truth about corporate cards

Understanding and preparing for the new payment experience

Short- and Long-Term Financial Goals for Every Life Stage

How Everyday Funding can improve cash flow

Checklist: 6 to-dos for after a move

Demystifying ISO 20022

Staying organized when taking payments

How to request a credit limit increase

Bank vs. brokerage custody

How your taxes can change after a major life event

4 ways Request for Payments (RfP) changes consumer bill pay

Access, flexibility and simplicity: How governments can modernize payments to help their citizens

Automate accounts payable to optimize revenue and payments

Automate escheatment for accounts payable to save time and money

Banking connectivity: Helping businesses deliver the easier, faster, more secure customer experience of the future

Cashless business pros and cons: Should you make the switch?

Escheatment resources: Reporting deadlines for all 50 states

Higher education and the cashless society: Latest trends

How to improve digital payments security for your health system

Transitioning from the military to the civilian workforce

How to avoid student loan scams

6 pandemic money habits to keep for the long term

How to fund your business without using 401(k) savings

Finance or operating lease? Deciphering the legalese of equipment finance

5 questions you should ask your custodian about outsourcing

7 tips to help grow your business after launch

Building a business with a great product and a greater purpose

Make holiday gift giving easier in a digital world

The growing importance of a strong corporate culture

Working with an accountability partner can help you reach your goals

How to create a financial plan to grow your LGBTQ+ family

What to do with your tax refund or bonus

LGBTQ+ family planning: 3 questions to ask employers

Is your restaurant Google-friendly?

Mapping out success for a small-business owner

Employee benefit plan management: trustee vs. custodian

Delivering powerful results with SWIFT messaging and services

Empowering managers with data automation and integration

Sophisticated investors reduce costs with block trading

Understanding the role of authorized participants in exchange-traded funds

OCIO: An expanding trend in the investment industry

Alternative investments: How to track returns and meet your goals

Green ideas: How sustainable finance benefits businesses

Protecting cash balances with sweep vehicles

Preparing for your custodian conversion

Work flexibility crucial as municipalities return to office

Why other lenders may be reaching out to your employees

What’s the difference between Fannie Mae and Freddie Mac?

Technology Financing

Sustainability + mobility: Trends and practical considerations

Save time with mobile apps for business finances

4 benefits of independent loan agents

High-cost housing and down payment options in relocation

How RIAs can embrace technology to enhance personal touch

Look to your custodian in times of change

Manufacturing: 6 supply chain optimization strategies

Mortgage buydowns and subsidies in today’s talent-focused relocation policies

Digital processes streamline M&A transactions

Treasury management innovations earn Model Bank awards

Overcoming the 3 key challenges of a lump sum relocation program

What goes into private equity fund calculation?

Investment management platforms: Easily enter the Irish funds market

Ask an expert Q&A: automation and artificial intelligence trends in Luxembourg

Tapping into indirect compensation to recruit foreign talent

A checklist for starting a mobility program review

An asset manager’s secret to saving time and money

Assisting transferees in a high mortgage interest rate environment

At your service: outsourcing loan agency work

Challenging market outlook reveals the power of partnership

3 financial tools to help automate your finances

Get back on track with your New Year’s financial resolutions

How I did it: Bought a home without a 20 percent down payment

Crypto + Relo: Mobility industry impacts

Changes in credit reporting and what it means for homebuyers

For today's relocating home buyers, time and money are everything

How to increase your savings

P2P payments make it easier to split the tab

How to gain financial independence from your parents

How to Adult: 5 ways to track your spending

Checklist: 10 questions to ask your home inspector

Closing on a house checklist for buyers

How to accept credit cards online

Unexpected expenses: 5 small business costs to know and how to finance them

How to identify what technology is needed for your small business

Key considerations for online ordering systems

Tools that can streamline staffing and employee management

U.S. Bank Regulatory Outlook Report 2022 Edition

How real-time inventory visibility can boost retail margins

Honey Luxury Beauté: growing a side project into an eye-catching beauty business

Improve online presence your business

Common small business banking questions, answered

How increased supply chain visibility can combat disruptors

How compound interest works

How to track expenses

How to build wealth at any age

How a family-owned newspaper is serving its community

Tips and tools for tax season and beyond

How one organization is funding equity in the Chicago area

Making the leap from employee to owner

5 tips for parents opening a bank account for kids

Automating healthcare revenue cycle

Starting a business with a friend: How to talk about it

How small business owners can budget for the holiday season

How to save more money in 2024

Financial goals for 2024 a 12-month planning guide

What are alternative investments?

Investment strategies by age

How to start investing to build wealth

5 questions to help you determine your investment risk tolerance

These small home improvement projects offer big returns on investment

How I saved $10,000 in just one year

12 ways to reduce your taxable income

How to prevent fraud

Outsmart tax scams and keep your finances safe

Freelancer's tax guide: Simplify your filing process

U.S. Bank Regulatory Outlook Report | Q4 2022 Edition

Refining your search for an insurance custodian

Role of complementary new channels in your payments strategy

Keep your finances safe and secure: Essential tips for preventing check fraud

How to spot an online scam

What is financial fraud?

Live your money values in 2024

Common questions about electric vehicles (EVs)

Military spouse’s guide to navigating your career

In a digital world, Liberty Puzzles embraces true connection

Webinar: Mortgage basics: Finding the right home loan for you

8 Ways for small business owners to manage their cash flow

What is a mortgage?

Dear Money Mentor: What is cash-out refinancing and is it right for you?

Tips on how couples can learn to agree about money

Maximizing your deductions: Section 179 and Bonus Depreciation

Can ABL options fuel your business — and keep it running?

3 simple brand awareness tips for your business

5 financial goals for the new year

How to get started creating your business plan

How to financially prepare for pet costs

The lowdown on 6 myths about buying a home

What is a Certificate of Deposit? And what to know before opening an account

Collateral options for ABL: What’s eligible, what’s not?

ABL mythbusters: The truth about asset-based lending

How to set financial goals you will keep

10 ways to increase your home’s curb appeal

How I did it: Dug my way out of a five-figure student loan debt

How to budget 101: 6 strategies to try

Handling the finances of someone who has died: Terms and definitions

How to Adult: 7 tax terms and concepts you should know

When your spouse has passed away: A three-month financial checklist

What documents do you need after a loved one dies?

Checklist: financial recovery after a natural disaster

Simple steps to be ready for a natural disaster

Rebuilding finances after a natural disaster

3 steps to prepare for a medical emergency

Legal protections for growing LGBTQ+ families

Family planning for the LGBTQ+ community

How to plan and save for adoption and in vitro fertility treatment costs

LGBTQ+ adoption 101: What prospective parents should know

Preparing for adoption and IVF

11 essential things to do before baby comes

Webinar: Uncover the cost: Starting a family

12 financial goal examples to explore

Authenticating cardholder data reduce e-commerce fraud

Robo advisors vs. financial advisors: How are they different?

3 signs it’s time for your business to switch banks

3 ways to secure purchasing power

4 small business trends that could change the way you work

5 ways a business credit card program can grow your business

Why credit cards should be the first choice for business payments

Tips for realtors to help clients get their homeownership goals back on track

Are you ready to restart your federal student loan payments?

3 tips for saving money when moving to a new home

5 ways to maximize your garage sale profits

Building confidence in your finances and career

Pros and cons of a personal line credit

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

Lessons learned from experiencing a scam

Tips to earn that A+ in back-to-school savings

How to manage money tips

Why Bond Issuers Should Consider a Successor Trustee

5 tips for being a great board member

Your guide to smart money habits

Your guide to smart money habits

For today's homebuyers, time and money are everything

How to choose the right business checking account

Mindset Matters: How to practice mindful spending

Mobile banking tips for smarter and safer online banking

Uncover the cost: International trip

Uncover the cost: Wedding

A who’s who at your local bank

How to pay off credit card debt

5 tips to use your credit card wisely and steer clear of debt

How to build and maintain a solid credit history and score

How to improve your credit score

6 essential credit report terms to know

4 reasons why estate planning is important

What is Medicare? Understanding your coverage options

What Is a 401(k)?

Using 529 plans for K-12 tuition

Retirement quiz: How ready are you?

Retirement plan options for the self-employed

How to open and invest in a 529 plan

How to manage your finances when you're self-employed

How much life insurance do I need?

10 ways your income and assets can affect your taxes

Economic forecast for 2024: 3 key things to know

Leverage credit wisely to plug business cash flow gaps

The essential business tips for tax deductions

Financial Wellness Assessment

Banking basics: How to start saving

Managing debt

Mortgages after retirement: Here’s what to know

How to save for a dream vacation

Discovering your money personality can help you save

Ask an expert Q&A: European CLO market outlook

Investing myths: Separating fact from fiction in investing

Why Know Your Customer (KYC) — for organizations

6 timely reasons to integrate your receivables

Webinar: CRE technology trends

5 winning strategies for managing liquidity in volatile times

How the next evolution of consumer bill pay makes it easier to do business

Managing the rising costs of payment acceptance with service fees

Safeguarding the payment experience through contactless

COVID-19 safety recommendations: Are you ready to reopen?

Keeping up with an evolving investment industry

What corporate treasurers need to know about Virtual Account Management

Middle-market direct lending: Obstacles and opportunities

Managing complex transactions: what your corporate trustee should be doing

The tools you need to make your business boom.

A stress-free holiday starts now

4 questions you should ask about your custodian

Buying or leasing? Questions to ask before signing a contract

Trends in economics, immigration and mobility policy

Putting home ownership within reach for a diverse workforce

How this photography business persevered through tough times

How jumbo loans can help home buyers and your builder business

How to apply for a business credit card

Does your side business need a separate bank account?

Webinar: Leading through uncertainty: CFO Insights Executive Roundtable

Do you need a business equipment loan?

Strengthen your brand with modern POS technology

How to choose the right business savings account

5 questions business owners need to consider before taking out a loan

Prioritizing payroll during the COVID-19 pandemic

Meet your business credit card support team

How to establish your business credit score

5 tips to help you land a small business loan

7 uncommon recruiting strategies that you may not have tried yet

Business credit card support

5 principles for avoiding ethics pitfalls on social media

Rethinking common time management tips

5 affordable small business marketing ideas when you have no budget

Checklist: What you’ll need for your first retail pop-up shop

5 tips for helping employees raise ethics concerns

4 restaurant models that aren’t dine-in

Healthcare marketing: How to promote your medical practice

Omnichannel retail: 4 best practices for navigating the new normal

Why ecommerce for small business strategy is integral

Streamline operations with all-in-one small business financial support

Small business growth: 6 strategies for scaling your business

How to reward employees and teams who perform well

The costs of hiring a new employee

8 ways to increase employee engagement

Planning for restaurant startup costs and when to expect them

5 steps to take before transitioning your business

The moment I knew I’d made it: The Cheesecakery

Business tips and advice for Black entrepreneurs

Make your business legit

How a bright idea became a successful business (in Charlotte, North Carolina)

Starting a business? Follow these steps

How to establish your business credit score

Talent acquisition 101: Building a small business dream team

What is needed to apply for an SBA loan

10 tips on how to run a successful family business

How to sell your business without emotions getting in the way

Empowering team members

Unique requirements of large private equity firms

Guide for investing

Protect yourself from financial exploitation

Financial wellness webinars

Managing your finances in the military

Is your financial plan keeping pace with your life?

Real Good

Why retail merchandise returns will be a differentiator in 2022

5 things to know before accepting a first job offer

Protecting elderly parents’ finances: 6 steps to follow when managing their money

How does a home equity line of credit (HELOC) work?

How business owners are managing during the supply chain crisis

How does an electronic point of sale help your business keep track of every dime?

How a travel clothing retailer is staying true to its brand values

How to save money while helping the environment

Use this one simple email marketing tip to increase your reach

Technology strategies to complement your business plan

Planning self-care moments that matter (and how to finance them)

Opening a business on a budget during COVID-19

When to consider switching banks for your business

How to expand your business: Does a new location make sense?

Is raising backyard chickens a good idea financially?

Rule 18f-4: The limited use exception

How I did it: Grew my business by branching out

How a small business owner is making the workplace work for women

By the numbers: The gig economy

How small businesses are growing sales with online ordering

When small business and community work together

5 things to deinfluence in your finances

6 common financial mistakes made by dentists (and how to avoid them)

7 steps to prepare for the high cost of child care

How to decide when to shop local and when to shop online

How (and why) to get your business supplier diversity certification

5 myths about emergency funds

Business credit card 101

Do I need a credit card for my small business?

What kind of credit card does my small business need?

How to save for a wedding

What to keep in mind when buying a used car from a private seller

How I did it: Turned my side hustle into a full-time job

Checklist: Increase lead generation with website optimization

What does FDIC mean?

The role of ethics in the hiring process

An eco friendly debit card with roots in Haiti

Stay on budget — and on the go — with a mobile banking app

Essential marketing tools for any business

5 things to consider when deciding to take an unplanned trip

Creating positive money habits

How to talk to your lender about debt

Stay committed to your goals by creating positive habits

Webinar: Why planning for retirement should start now

Webinar build career best foot forward

Finding a side gig to fund your goals

How new parents can prepare for the costs of a new child

Quit your job to start a business: How to save enough

Tips for talking about money when friends earn more

Choosing your M&A escrow partner

5 tips for creating (and sticking to) a holiday budget

How a 13-year-old created a clothing line that reflects her passions

Money Moments: 3 tips for planning an extended leave of absence

How to test new business ideas

The banking app you need as a new parent

How can I help my student manage money?

Bank from home with these digital features

How a group fitness studio made the most of online workouts

7 steps to keep your personal and business finances separate

3 types of insurance you shouldn’t ignore

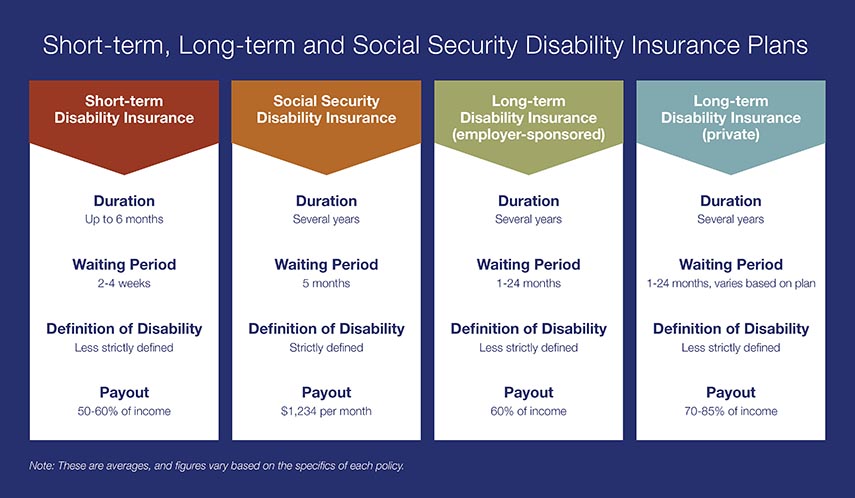

Is your employer long term disability insurance enough?

8 steps to choosing a health insurance plan

7 things to know about long-term care insurance

How I did it: Switched career paths by taking an unexpected pivot

The Anaheim Ballet: Making a difference through dance

5 unexpected retirement expenses

Estate planning checklist

Year-end financial checklist

How to prepare for a recession: 6 steps to take

6 tips for trust fund distribution to beneficiaries

Key components of a financial plan

Community and Coffee: How one small business owner is breaking down barriers

3 ways to gain loyalty with your customers

How community gave life to lifestyle boutique Les Sol

How I pivoted my business during COVID-19

Comparing term vs. permanent life insurance

The San Francisco bridal shop that’s been making memories for 30 years

How four women pivoted amidst a pandemic

5 tips for an empty nest

Community behind Elsa’s House of Sleep

How Wenonah Canoe is making a boom in business last

Achieving their dreams through a pre-apprenticeship construction program

How Lip Esteem is empowering women

How I did it: Transitioned from the military to a private sector career

How running a business that aligns with core values is paying off

How Gentlemen Cuts helps its community shine

How to search for jobs (and interview) in a virtual job market

4 steps to finding a charity to support

Meet the Milwaukee businessman behind Funky Fresh Spring Rolls

Tech lifecycle refresh: A tale of two philosophies

How to choose the right rewards credit card for you

5 steps to selecting your first credit card

How to winterize your vehicle

Don’t underestimate the importance of balancing your checking account

How to be prepared for tax season as a gig worker

6 questions students should ask about checking accounts

What you need to know as the executor of an estate

How to build a content team

CRE trends

5 financial benefits of investing in a vacation home

7 diversification strategies for your investment portfolio

Can fantasy football make you a better investor?

A guide to tax diversification and investing

Year end tax planning tips

4 major asset classes explained

ETF vs. mutual fund: What’s the difference?

Effects of inflation on investments

What applying for store credit card on impulse could mean

Credit: Do you understand it?

What types of credit scores qualify for a mortgage?

Test your loan savvy

Webinar: Mortgage basics: What’s the difference between interest rate and annual percentage rate?

How to manage money in the military: A veteran weighs in

How to roll over your 401(k)

4 times to consider rebalancing your portfolio

Credit score help: Repairing a bad credit score

How do I prequalify for a mortgage?

Can you take advantage of the dead equity in your home?

Home equity: Small ways to improve the value of your home

Webinar: Mortgage basics: How much house can you afford?

Is a home equity line of credit (HELOC) right for you?

Webinar: Mortgage basics: 3 Key steps in the homebuying process

Webinar: Mortgage basics: Buying or renting – What’s right for you?

How to use your home equity to finance home improvements

Webinar: Mortgage basics: What is refinancing, and is it right for you?

Should you get a home equity loan or a home equity line of credit?

6 questions to ask before buying a new home

What is refinancing a mortgage?

What is an escrow account? Do I have one?

Quiz: How prepared are you to buy a home?

10 questions to ask when hiring a contractor

What to know when buying a home with your significant other

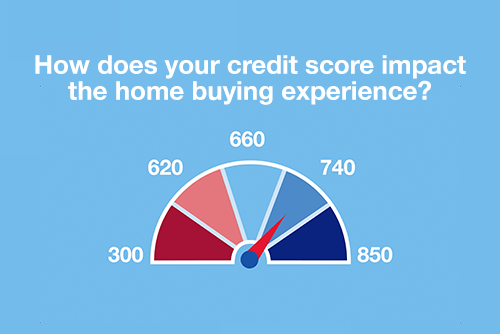

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

What is a home equity line of credit (HELOC) and what can it be used for?

Dear Money Mentor: When should I refinance a mortgage?

Building a dream home that fits your life

Are professional movers worth the cost?

First-time homebuyer’s guide to getting a mortgage

Beyond the mortgage: Other costs for homeowners

How I did it: Bought my dream home using equity

Get more home for your money with these tips

Saving for a down payment: Where should I keep my money?

How I did it: Built living spaces to support my family

Community activist achieves dream of homeownership

Bringing economic opportunity to underserved communities one home at a time

Managing the impacts of appraisal gaps in a hot housing market

Is it the right time to refinance your mortgage?

Spring cleaning checklist for your home: 5 budget-boosting tasks

Overcoming high interest rates: Getting your homeownership goals back on track

Is it cheaper to build or buy a house

Starting your homebuying journey

Home improvements with the best ROI

PCS moving checklist for military spouses and families

Home buying myths: Realities of owning a home

Webinar: 11 insider tips for student debt

House Hacks: How buying an investment property worked as my first home

How we did it: Converted to solar power

How to maximize your credit card rewards

How to use credit cards wisely for a vacation budget

Which debt management technique is right for you?

Should you buy a house that’s still under construction?

Dear Money Mentor: How do I begin paying off credit card debt?

10 uses for a home equity loan

Know your debt-to-income ratio

Best travel credit card perks for family vacations

Your guide to breaking the rental cycle

Understanding your military GI Bill benefits

Webinar: How to pay for college

Is a home equity loan for college the right choice for your student

Travel for less: Smart (not cheap) ways to spend less on your next trip

How to apply for federal student aid through the FAFSA

Things to know about the Servicemembers Civil Relief Act

Should you buy now, pay later?

Steer clear of overdrafts to your checking account

U.S. Bank asks: Do you know what an overdraft is?

Tips and resources to help in the aftermath of a natural disaster

Tips for working in the gig economy

Which is better: Combining bank accounts before marriage — or after?

Tips to overcome three common savings hurdles

Money Moments: 8 dos and don’ts for saving money in your 30s

Save time and money with automatic bill pay

A passion for fashion: How this student works the gig economy

Money Moments: 3 smart financial strategies when caring for aging parents

Helpful tips for safe and smart charitable giving

Growing your savings by going on a ‘money hunt’

Why a mobile banking app is a ‘must have’ for your next vacation

Tips to raise financially healthy kids at every age

How to avoid being the victim of a digital payments scam

Is it time to get a shared bank account with your partner?

How I kicked my online shopping habit and got my spending under control

How to financially prepare for a military PCS

How to set yourself up for success in your first job

How to stay positive when searching for a job

Friction: How it can help achieve money goals

It's possible: 7 tips for breaking the spending cycle

What to consider before taking out a student loan

Earning in the gig economy: Gladys shares her story

Financial checklist: Preparing for military deployment

Here’s how to create a budget for yourself

Common unexpected expenses and three ways to pay for them

Webinar: Common budget mistakes (and how to avoid them)

Checking and savings smarts: Make your accounts work harder for you

Are savings bonds still a thing?

3 awkward situations Zelle can help avoid

Allowance basics for parents and kids

9 simple ways to save

Do you and your fiancé have compatible financial goals?

3 ways to keep costs down at the grocery store (and make meal planning fun)

What military service taught me about money management

Money muling 101: Recognizing and avoiding this increasingly common scam

From LLC to S-corp: Choosing a small business entity

Is online banking safe?

How-to guide: What to do if your identity is stolen

8 tips and tricks for creating and remembering your PIN

Recognize. React. Report. Caregivers can help protect against financial exploitation

Recognize. React. Report. Don't fall victim to financial exploitation

5 tips for seniors to stay a step ahead of schemers

Webinar: U.S. Bank asks: Are you safe from fraud?

Learn to spot and protect yourself from common student scams

College budgeting: When to save and splurge

How I did it: Paid off student loans

The A to Z’s of college loan terms

How to save money in college: easy ways to spend less

The password: Enhancing security and usability

BEC: Recognize a scam

Top 3 ways digital payments can transform the patient experience

Hospitals face cybersecurity risks in surprising new ways

3 European market trends to watch

Costs to consider when starting a business

How Shampoo’ed is transforming hair and inspiring entrepreneurs

Questions to ask before buying a car

Should you give your child a college credit card?

Overdrafts happen: Steps to get you back on track

Webinar: Uncover the cost: Building a home

Webinar: Mortgage basics: Prequalification or pre-approval – What do I need?

Adulting 101: How to make a budget plan

You can take these 18 budgeting tips straight to the bank

Your financial aid guide: What are your options?

Webinar: AP automation for commercial real estate

How I did it: Learned to budget as a single mom

U.S. Bank Student Scholarship

Cryptocurrency custody 6 frequently asked questions

How you can take advantage of low mortgage rates

Depositary bank and collateral agent

Social Security benefits questions and answers

Multigenerational household financial planning strategies

Major purchases: How to pay for big ticket items

The different types of startup financing

Banking basics: Avoiding fraud and scams

Crack the SWIFT code for sending international wires

4 ways to outsmart your smart device

Buying a home Q&A: What made three homeowners fall in love with their new home

Working after retirement: Factors to consider

Why year-round giving is important

Why compound interest is important

What types of agency accounts are available for investors?

Personal loans first-timer's guide: 7 questions to ask

Consolidating debts: Pros and cons to keep in mind

Myth vs. truth: What affects your credit score?

Improving your credit score: Truth and myths revealed

How to spot a credit repair scam

Decoding credit: Understanding the 5 C’s

Dear Money Mentor: How do I set and track financial goals?

Understanding guardianship and power of attorney in banking

What I learned from my mom about money

Meet the student with a passion for science, helping others and reaching goals

Military finance: How to create a family budget after military service

6 ways to spring clean your finances and save money year-round

Managing money as a military spouse during deployment

How to cut mindless spending: real tips from real people

Real world advice: How parents are teaching their kids about money

What financial advice would you give your younger self?

Essential financial resources and protections for military families

How to stop living paycheck to paycheck post-pay increase

Practical money tips we've learned from our dads

What you need to know about renting

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

Dear Money Mentor: How do I pick a savings or checking account?

When to and benefits of refinancing a car loan

Car shopping: Buying versus leasing your next vehicle

How I did it: Deciding whether to buy an RV

What you should know about buying a car

I own two electric vehicles. Here’s what I’ve learned about buying and driving EVs.

Take the stress out of buying your teen a car

How to choose the best car loan for you

Give a prepaid rewards card for employee recognition

How I did it: Joined a board of directors

How AI in treasury management is transforming finance

Practical money skills and financial tips for college students

Tips for navigating a medical hardship when you’re unable to work

Making a ‘workout’ work out as a business

How and when to ask for a raise

Money management guide to financial independence

Money Moments: How to manage your finances after a divorce

Personal finance for teens can empower your child

5 unique ways to take your credit card benefits further

5 reasons why couples may have separate bank accounts

U.S. Bank asks: Transitioning out of college life? What’s next?

5 tips to use your credit card wisely and steer clear of debt

Co-signing 101: Applying for a loan with co-borrower

What’s a subordination agreement, and why does it matter?

Understanding the true cost of borrowing: What is amortization, and why does it matter?

What’s your financial IQ? Game-night edition

How to use debt to build wealth

How to talk about money with your family

How having savings gives you peace of mind

How to build credit as a student

30-day adulting challenge: Financial wellness tasks to complete in a month

How to protect your digital assets in your estate plan

5 ways to build your business through community engagement

Money Moments: Tips for selling your home

How I did it: My house remodel

Webinar: How to stay safe from cyberfraud

First-timer’s guide to savings account alternatives

How mobile point of sale (mPOS) can benefit your side gig

Everything you need to know about consolidating debts

Making the cross-border payment decision: Wire or international ACH?

Accommodating the growing complexity of private equity funds

Webinar: Robotic process automation

Does your savings plan match your lifestyle?

Student checklist: Preparing for college

Email marketing: 10 mistakes to avoid

Celebrity Cake Studio’s two decades of growth and success

Automating escheatment earns respected innovation award

How Al’s Breakfast is bringing people together

3 tips for saving money easily

What you should know about licensing agreements

Can faster payments mean better payments?

Webinar: CRE Digital Transformation – Balancing Digitization with cybersecurity risk

Hospitals face cybersecurity risks in surprising new ways

Webinar: CRE Digital Transformation – Balancing Digitization with cybersecurity risk

Resources for managing financial matters after an unexpected death

5 steps for creating an employee recognition program

Four ways to make a strong resume for your first real job

Webinar: Uncover the cost: College diploma

Answering the ABL question

DIY home projects 101: tips from a first-timer

Crypto + Homebuying: Impacts on the real estate market

Your quick guide to loans and obtaining credit

How to hire employees: Employee referral vs. external hiring

Myths vs. facts about savings account interest rates

Military homeownership: Your guide to resources, financing and more

U.S. Bank asks: Do you know your finances?

Break free from cash flow management constraints

BEC and deepfake fraud

Webinar: Bank Notes: College cost comparison

How you can prevent identity theft

How tenacity brought Taste of Rondo to life

Best practices for optimizing the tech lifecycle

Do I need a financial advisor?

How a bar trivia company went digital during COVID-19

Booming in the gig economy: A new chapter leveraging 45 years of experience

4 questions to ask before you buy an investment property

Your guide to starting a job: Resources to help along the way

4 steps that give your business an SEO boost

How much money do I need to start investing?

How do interest rates affect investments?

Healthcare costs in retirement: Are you prepared?

Good debt vs. bad debt: Know the difference

Preparing for homeownership: A guide for LGBTQ+ homebuyers

Parent checklist: Preparing for college

What you need to know about identity theft

Webinar: Tips to avoid today’s cyber threats

U.S. Bank asks: What do you know about credit?

Financial steps to take after the death of a spouse

Financial fitness quiz

Annual insurance review checklist

7 financial questions to consider when changing jobs

Webinar: 5 myths about emergency funds

How to best handle unexpected expenses

Enhancing the patient experience through people-centered payments

Digital trends poised to reshape hotel payments

Transition to international ACH

Maximizing your deductions: Section 179 and Bonus Depreciation

Unexpected cost savings may be hiding in your payment strategy

Evaluating interest rate risk creating risk management strategy

Authenticating cardholder data reduce e-commerce fraud

Ask an expert Q&A: 3 US ETF trends and their impact in Europe

Colleges respond to student needs by offering digital payments

Luxury jeweler enhances the digital billing and payment customer experience